Cumberland County plans to spend nearly $540 million this year, with the majority of the money coming from property taxes. The county Tax Administration department announced that 2021 tax bills are being mailed today and that property owners will have until Jan. 5 to pay their bills.

“After Jan. 5, unpaid tax bills will begin to incur a 2 percent interest charge the first month and 0.75 percent interest charge each month thereafter, beginning Feb. 1,” Joseph R. Utley, Jr., the county’s tax administrator, said in a Thursday news release.

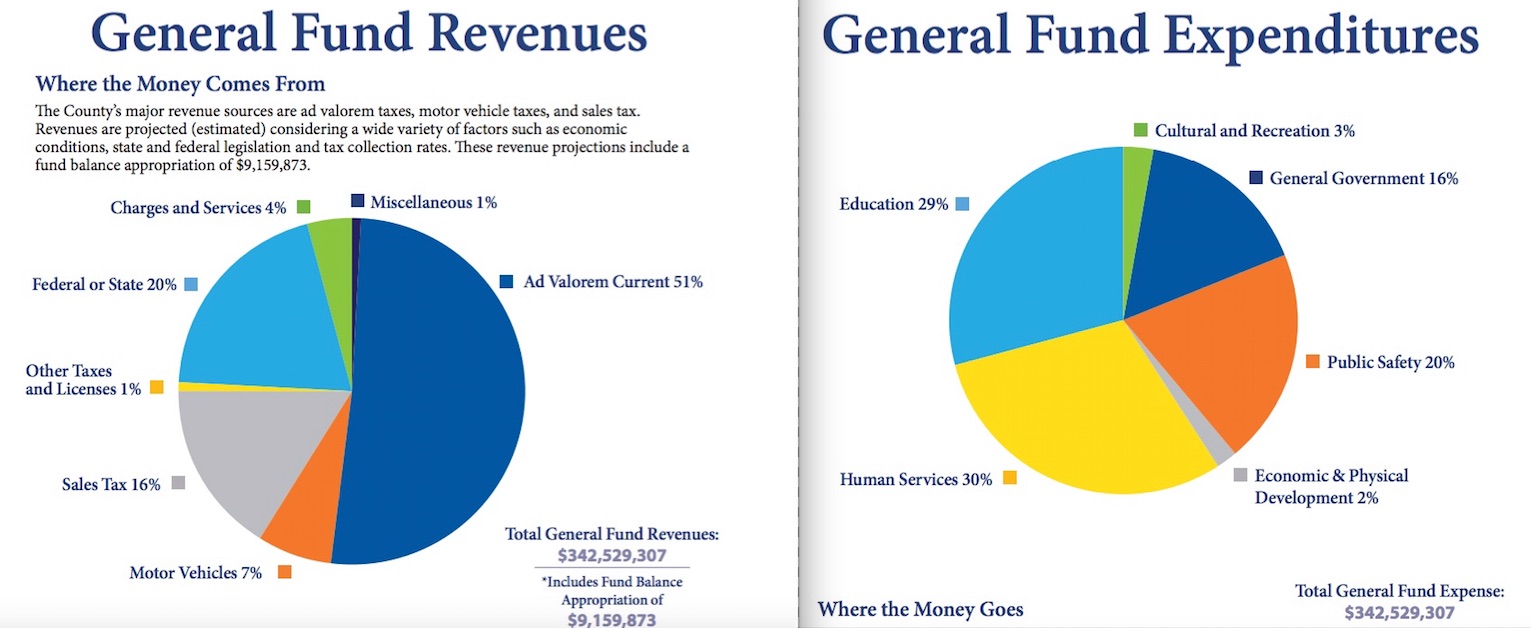

In addition to taxes owed on property within Cumberland County, the bill also will include municipal and other taxes. Although the county will take in over half a billion dollars, a smaller amount -- $343 million -- will go toward the main operating budget, known as the General Fund.

Property taxes, however, don’t foot the entire bill for the county’s general government. Just over half of the budget is funded by the ad valorem revenues.

(An ad valorem tax is based on the assessed value of items such as real estate or personal property. The most common ad valorem taxes are levied on real estate.)

In addition to ad valorem property-tax revenue (51 percent), overall county revenues come from federal and state sources (20 percent); sales tax -- run through state collections -- (16 percent); and motor-vehicle taxes (7 percent).

Although you may receive a property tax bill, many are paid by a mortgage company using funds from your escrow account.

So where will the money you pay in property taxes go? First, the county will distribute the tax revenues it collected on behalf of municipalities, such as Fayetteville and Hope Mills and non-municipal special districts. For the 2021-22 fiscal year, the largest percentage of county money (30 percent) will go toward human services, often administered by the department of social services. Education will get a little over $100 million (29 percent). That is in addition to the state’s contribution to education (mostly salaries). Local school districts build and maintain school facilities and also pay for personnel and services not covered by the state. Twenty percent of the $343 million county general fund goes toward public safety and 16 percent toward general government.

Taxpayers can pay bills online, by mail, by phone or in person. Go to cumberlandcountync.gov/departments/tax-group/tax to pay online with an electronic check, debit card or major credit card. A credit or debit card convenience fee is charged. There is no fee for electronic checks. To pay by phone, call 1-866-441-6614. Phone payments must be made with a major credit card or debit card. A credit or debit card convenience fee is charged.

Taxpayers also can set up an online bill pay option with their financial institution.

“It is important for taxpayers using this option to verify and update the tax bill number on file with their bank, as it can change annually,” according to Utley.

Mail payments with a remittance coupon to:

Cumberland County Tax Collector

P.O. Box 538313

Atlanta, GA 30353-8313

Mail payments without a remittance coupon to:

Cumberland County Tax Collector

P.O. Box 449

Fayetteville, NC 28302-0449

Mailed payments must be made with a check or money order payable to Cumberland County Tax Collector.

Taxpayers can also make payments in person from 8 a.m. to 5 p.m. at the Tax Administration office located on the fifth floor of the Cumberland County Courthouse, 117 Dick Street in Fayetteville. The office accepts cash, check, money order and major credit and debit cards.

A Payment Plan Option form has been included with this year’s tax bills for taxpayers interested in making monthly payments for property taxes. The form can be completed and submitted with the first payment.

For more information, call 910-678-7507 or visit co.cumberland.nc.us/tax.

GFBJ staff joined by Publisher Marty Cayton’s wife pictured at the 2025 Q2 Power Breakfast. Left to right: Faith Hatton, Joy Cayton, Marty Cayton, Ellie Rhoades and Stephanie Meador.Well, in case LinkedIn failed to inform you I have now been at the G

The 6,000-square-foot station house will provide cover and added security for Campbell’s four mobile clinics. Construction is expected to be wrapped in August of 2025. Photos by Campbell University. Campbell’s four Mobile Health and Education Cl

Dr. Geddis Dr. Janell Geddis assumed the role of president for Miller-Motte College’s Fayetteville campus in February of 2024. Dr. Geddis joined MMC with 15 years of experience in higher education, with most of her roles serving community