Toronto-Dominion Bank Group and First Horizon Corporation have announced they

have signed an agreement for TD to acquire First Horizon in an all-cash transaction for $13.4 billion.

First Horizon currently has three locations in Greater Fayetteville Business Journal’s coverage area, with two locations in Fayetteville and one in Southern Pines.

Through this transaction, TD marks its place in its long-term growth strategy in the United States as a premier regional bank.

TD Bank is the fifth largest bank in North America by assets and serves more than twenty-six million customers in three key businesses operating in a number of locations around the globe.

“First Horizon is a great bank and a terrific strategic fit for TD. It provides TD with immediate presence and scale in highly attractive adjacent markets in the U.S. with significant opportunity for future growth across the Southeast,” said Bharat Masrani,

group president and CEO of TD.

“Working with the First Horizon team, TD will build upon the success of its strong franchise and deliver the legendary customer experiences that differentiate us in every market across our footprint.”

Following the closing of the transaction, president and CEO of First Horizon Bryan Jordan will serve as TD vice chair and be named to the Board of Directors of TD’s U.S. banking entities as director and chair.

“We have built a very strong business at First Horizon, and by joining forces with TD, we will create extraordinary value for our key stakeholders with a shared customer-centric strategy, enhanced scale and a broader product set for our clients. This is a

true growth story,” said Jordan.

“We have long respected TD as a leader in U.S. banking and are confident that its continued and growing investments in our local markets will extend our long history of community support,” he continued. “Thank you to our First Horizon associates for

their efforts and dedication to our clients and communities as we continue to deliver for them every day. We look forward to successfully completing this transaction and are excited to join TD.”

The acquisition will add nearly $55 billion of loans and $75 billion of deposits to TD.TD has also agreed to invest $494 million in non-voting First Horizon preferred stock to support First Horizon’s growth and franchise enhancement.

This transaction will close approximately in the first quarter of 2023, and is expected to result in a fully-synergized return on invested capital of ten percent. If the trans-

action is not closed by November 27, 2022, First Horizon shareholders will receive an additional $0.65 per share on an annualized basis from November 27 through the day prior to closing.

If not closed by February 27, 2023, the transaction will be terminated.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

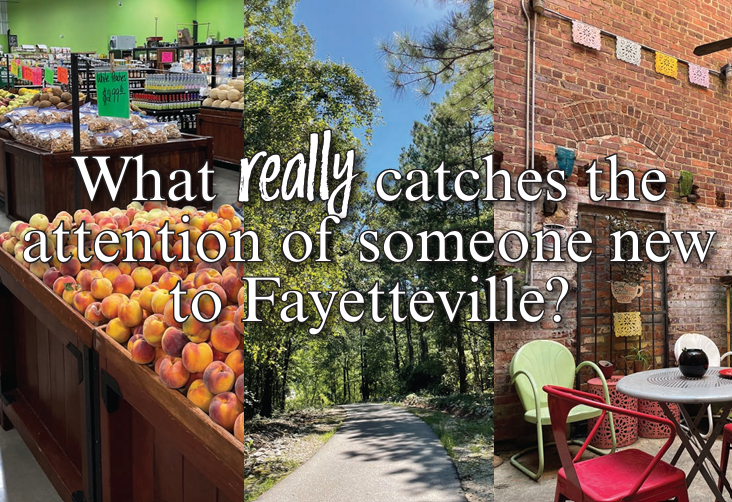

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as