Fitch Ratings, an internationally recognized and award-winning provider of credit ratings, commentary and research, recently assigned a AA+ rating to $300 million State of North Carolina limited obligation (Build NC) bonds, series 2022A.

Fitch also announced that it affirmed $1 billion in outstanding Build NC limited obligation bonds at 'AA+'.

Build NC went into place in January 2019. The North Carolina Department of Transportation program is a financing tool that aids in the process of “critical road projects at the regional and division tiers that do not qualify for a similar federal funding tool,” NCDOT’s website states.

The tool was established in hopes that, by fulfilling its goal, Build NC would aid infrastructure, the workforce through job creation and availability, healthcare facilities, and opportunities in education.

Under the State Transportation Improvement Program, NCDOT has successfully “made process improvements that led to the acceleration of 350 projects and made room for an additional 144 projects,” the website says.

Fitch calls the Rating Outlook for the bonds “stable.”

“The 'AA+' rating for the Build NC limited obligation bonds is not considered to be distinct from the operations of the State of North Carolina and is capped one notch below the state's 'AAA' Issuer Default Rating (IDR) given the appropriation requirement,” the organization said. “Fitch expects long-term growth to resume at a pace that exceeds long-term expectations for national inflation as the economy recovers from the pandemic-induced downturn. Given expected leveraging and current high debt service coverage by revenues in the HTF, the bond structure has robust resilience to economic downturns.”

Fitch also reported an anticipation of sound growth in revenue stream.

“Growth of revenues deposited in the [Highway Trust Fund], which include

motor vehicle usage fees based on the retail value of purchased or leased motor vehicles when titled in NC (highway use taxes), motor fuel taxes, and a variety of other transportation-related fees, has been strong for the past ten years, following a steep decline during the Great Recession,” the organization said. “Fitch expects pledged revenues to track relatively strong long-term growth in the North Carolina economy, above the long-term national rate of inflation, reflecting in part population growth that is higher than the national average.”

Another key rating driver that Fitch Ratings focused on was resilience. “Given current statutory limits on leverage and ample coverage of debt service and standing appropriations that support debt service for bonds issued by the NC Turnpike Authority, the HTF can easily absorb a decline in revenues expected to result from a moderate recession scenario or one equivalent to the largest historical decline,” Fitch reported.

Lastly, Fitch said that the state’s commitment to “annually’s appropriate debt service from the [Highway Trust Fund]” limits the rating to one notch below N.C.’s AAA Issuer Default Rating.

Revenues in FY 2021 were stronger than predicted, despite a previous forecast that revenues would decline because of the pandemic. In 2021,

revenues totalled $1.56 billion.

“Highway use taxes increased 19% yoy, offsetting a 31% decline in motor fuel taxes that were deposited to the HTF. Debt service coverage, inclusive of annual statutory commitments, remained ample at 9.6x.,”

Fitch Ratings reported. “The revenue forecast for the fiscal 2022 was updated in June 2021, with the HTF forecast to receive $1.55 billion, essentially flat to fiscal 2021, but reflecting improved economic conditions, a

rebound in vehicle sales, as well as in motor fuel consumption.”

The unexpected revenue come with built-in resilience, Fitch Ratings explained. “Based on fiscal 2021 revenues of $1.56 billion, the HTF could

withstand an 86% decline in revenues and maintain sum sufficient coverage of MADS ($215.143 million), which includes both debt service on the Build NC bonds and standing appropriations for transfers to the NC Turnpike Authority for debt service and the NC Port Authority for capital projects,” the organization said.

Owners Dana and Tracy Horne planted their vineyard in 2009. In 2019, they introduced their u-pick vineyard, and visitors loved the addition. They’ve also added a 4,608 sq ft. venue available to rent for events. Photo by Emily Grace Photography.Twiste

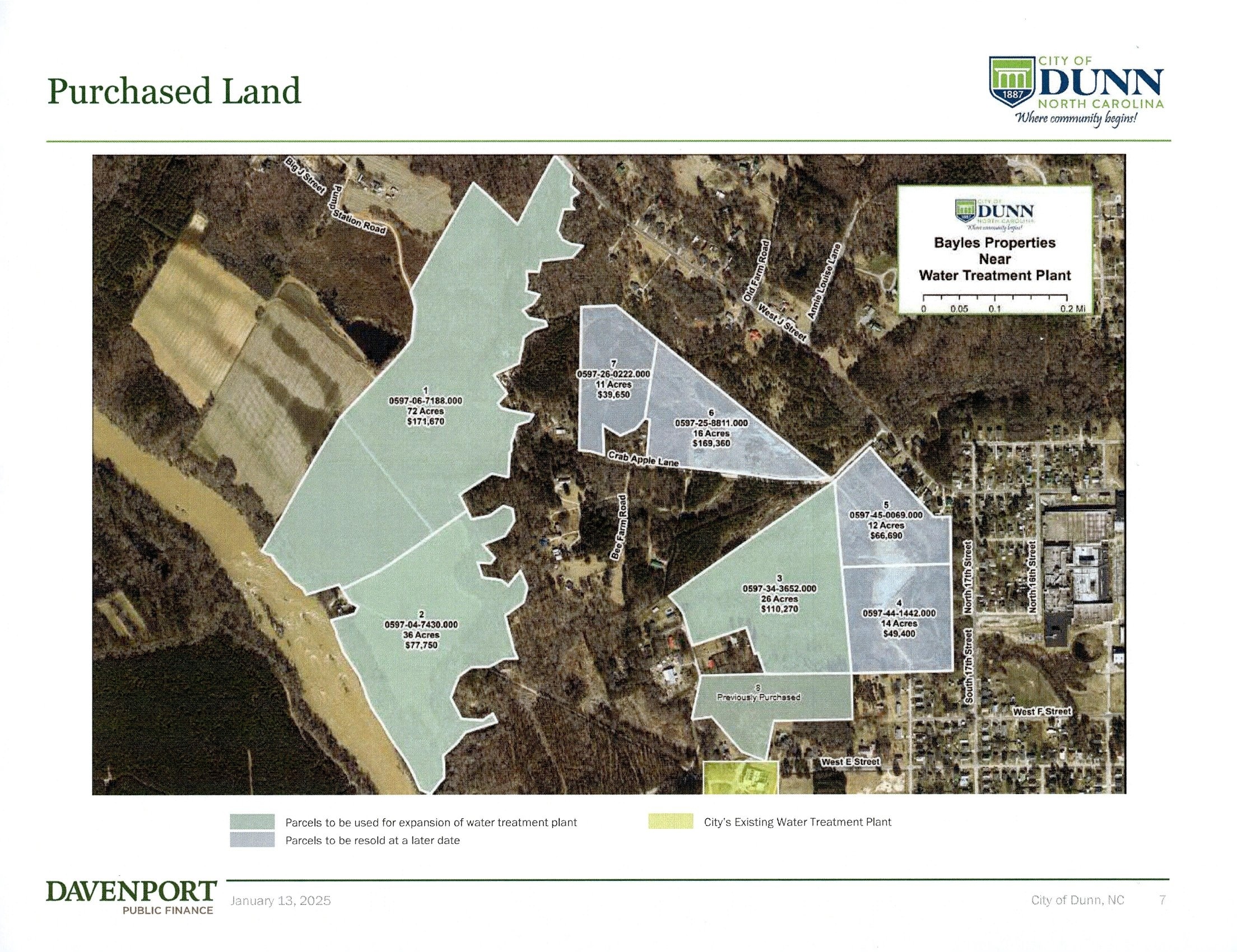

Mayor Elmore saw the necessity for this land acquisition when he first took office six years ago. The land owner recently came around to negotiations on the condition the sale was for all of his parcels. This is more land than the City of Dunn curren

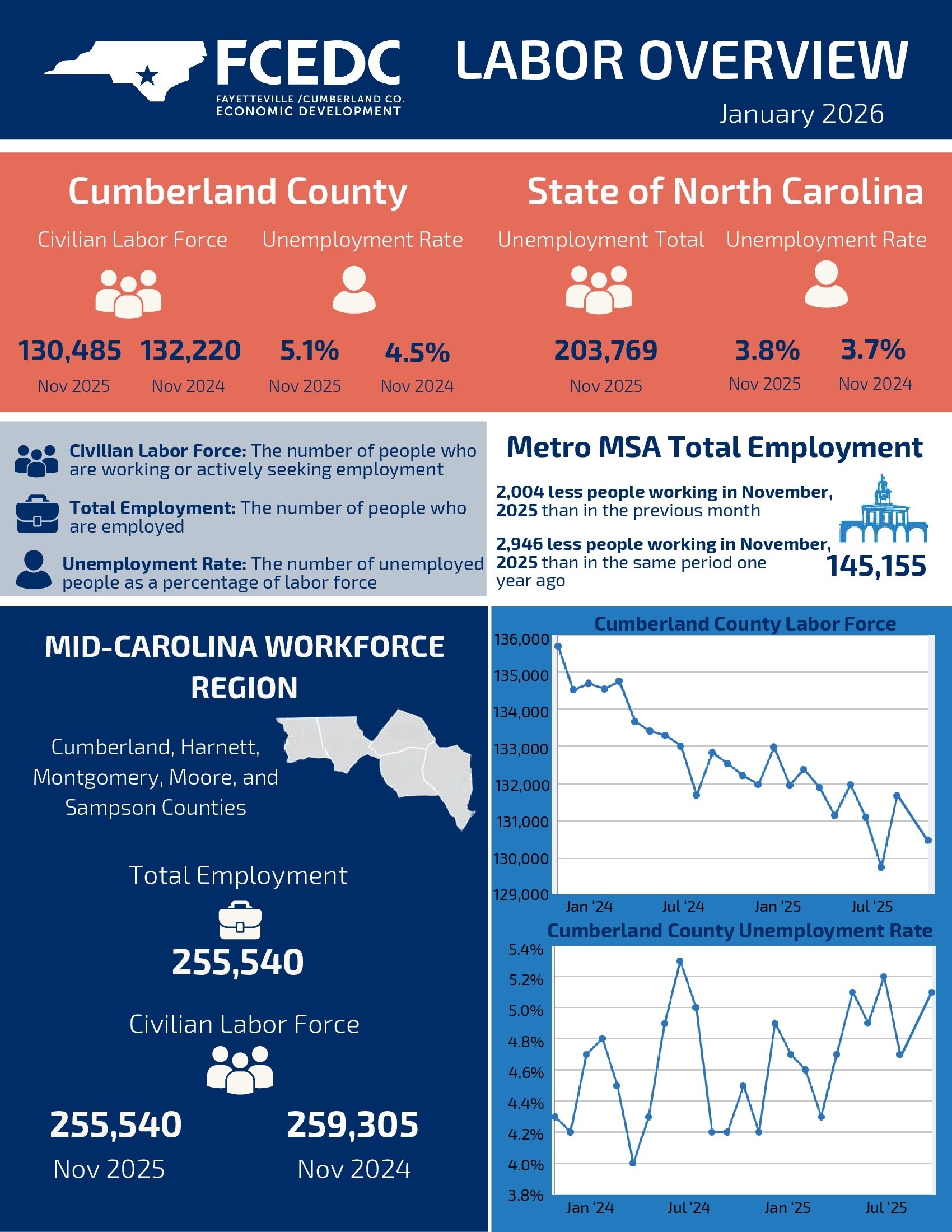

While the weather outside is cold, the local job market is hot. Fayetteville employers continue to bring on additional talent across a variety of industries.Quality employment opportunities are available at companies across Fayetteville and Cumberlan