Fitch Ratings of New York has recently affirmed its 'A+' Issuer Default Rating (IDR) and the 'A' rating on Fayetteville State University’s outstanding general revenue bonds (GRBs) issued by the University of North Carolina Board of Governors (BOG).

At the same time, Fitch also affirmed the 'A-' rating on the university’s outstanding limited obligation bonds (student housing project) (LOBs) issued by Fayetteville State. Such ratings are a factor in interest rates when institutions and governments borrow money. This action further confirms the University’s improved fiscal stability and steady growth. Standard and Poor’s (S&P) Global Ratings recently upgraded FSU’s issuer credit rating (ICR) to A-.

“We continue to work closely with our partners in the UNC System and state government to further strengthen FSU’s financial foundation and fulfill our mission to offer a premier education to all who seek it, regardless of their circumstances,” said FSU Chancellor Darrell T. Allison, J.D. in a press release. “Our efforts have vastly improved the university’s fiscal health and future stability, further ensuring our commitment to students today and tomorrow. Our upgraded rating, along with this recent affirmation, confirms our continued growth and strength.”

Fitch’s assessment pointed to FSU’s core strengths, particularly the stable state of North Carolina (AAA/Stable) operating appropriations (a significant 40.2 percent of operating revenues in fiscal 2022), and stable enrollment with a solid regional demand niche.

“FSU has navigated a challenging financial climate over the last several years — including the significant negative impact of the pandemic — through careful stewardship and strategic use of its resources while diligently managing its fiscal responsibilities,” said Lillian Wanjagi, Ed.D., FSU vice chancellor for business and finance and chief financial officer, in a press release. “Those efforts have methodically and systematically buoyed the university’s credit outlook and bolstered its ability to provide a world-class education for North Carolinians, our military and beyond. Our recent S&P credit rating upgrade, combined with Fitch Ratings’ current affirmation, clearly indicates that we’re moving in the right direction.”

The IDR also reflects the university’s continued ability to meet its financial obligations and reduce its vulnerability to adverse conditions, thanks to strong state support.

Fitch identified key rating factors for FSU, including:

Fitch also pointed to recent strategic initiatives at FSU aimed at strengthening its academic opportunities and growing its footprint to support its strong rating:

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

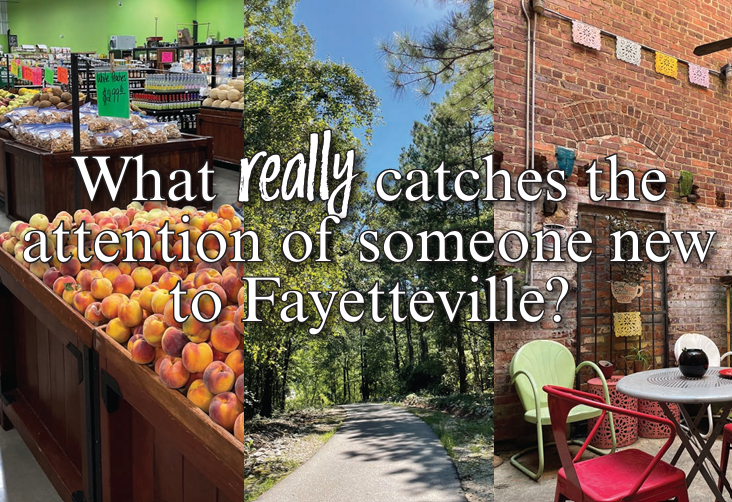

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as