There are a number of factors to consider if you are looking to invest in real estate as means of receiving a return on investment. Many investors in real estate focus on characteristics such as age, condition, construction quality, location, size and use, which are all very important factors. The question many don’t think about is what variables you analyze if all the forementioned factors are almost identical or too similar to discern.

The next consideration for a prudent investor is the quality of the tenant that will be paying the landlord’s rental amount every month. Quality of tenant is often based on measurements such as bond ratings, as well as overall observations of the industry and that particular tenant’s position in that industry. This is to determine the tenant’s long-term viability and potential to miss rental payments or fail overall as a company or franchise. Though, at a certain point of searching for an investment property you will find that all properties in a certain class might have similarly “safe” tenant ratings and therefore, a choice between multiple assets. The class of the “safest” tenants are often referred to as credit tenants, but understand investors still see certain credit tenants as more safe and less safe than other.

Following the determination of tenant credit worthiness, an investor must consider whether the terms and rate of the lease are fair and within market norms. It should be understood that just because the rent is currently higher than other like properties doesn’t always mean it is the best investment. The savvy investor must also consider that if the rental rate is above market the tenant may be more likely to decide to find a new location and vacate the space at the end of the lease unless renegotiated downward. Before we arrive at the last factor to be discussed, any buyer should be aware that a myriad of lease contracts exist, and they may include elements such as specifics on responsibility of expenses, early-termination clauses, and other elements that may allow a tenant to exit a contract in an easier manner. It is always advised to discuss these contract questions with an attorney.

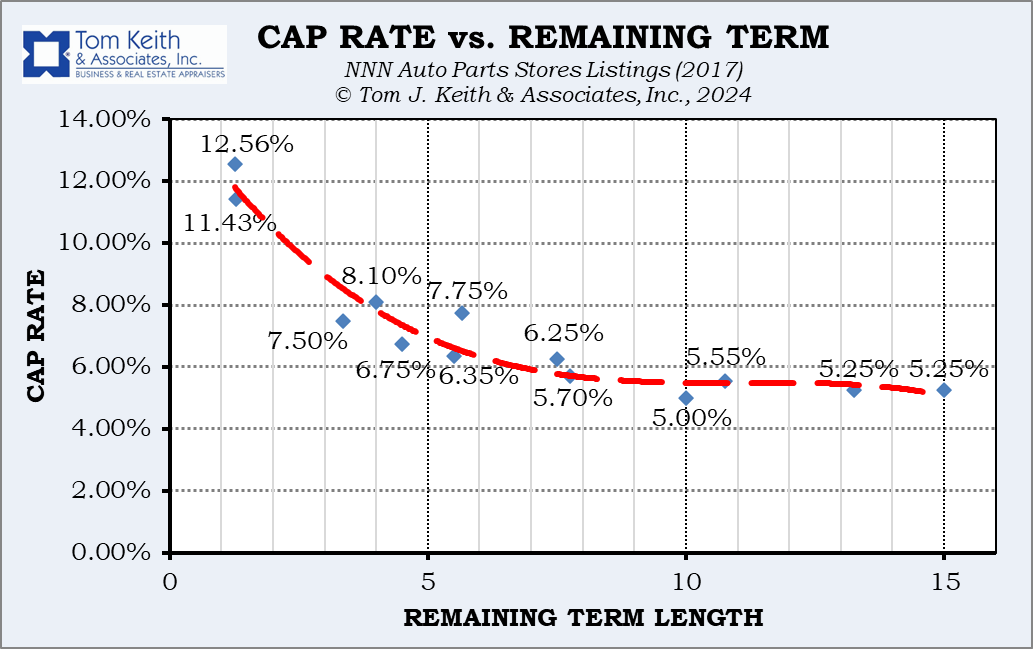

This last factor we will examine, often missed as a focal point for many investors, involves the length of the time remaining on a lease contract. The length of remaining time on an existing lease is a crucial factor when looking at high investment grade property. The chart below really tells the story for one particular market and illustrates the implications of this remaining time on a lease and compares such with the Capitalization Rate, or simply the annual Net Operating Income divided by the Price, and a well-known measurement of risk.

As one might have assumed, the longer the remaining term length, the lower the risk, the rate of return and the greater the price. This study above is one that consists of net leased auto parts store Listings in North Carolina, and this gives a general theme to what is seen in many real estate investment property types. Based on the data noted above we see that once a property gets to a remaining lease term of less than 7 years with a national tenant the Capitalization Rate starts to increase and the price correspondingly decreases.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as