In an age filled with rapid technological growth, businesses are often faced with the challenge of either meeting the evolving standards or being left behind.

Completely virtual banks, like Ally Bank, allow users to sign up over a web browser or app, using their social security number, a username, and a password. From there, they are able to connect their fully online bank to their local bank account for transfers and deposits all at the click of a button.

As easy as the process of online banking is, virtual banks still rely on brick-and-mortar banks for cash withdrawals and often need a client base comfortable with robotic responses for customer service. Human-to-human help, for many of these apps, has become a last resort. Additionally, banks have seen the rise of online payment methods where cash used to be necessary; yard sales, lemonade stands, and IOUs all find an easy fix in prevalent apps such as Venmo, Cashapp, Paypal and other virtual ways to pay.

For the local banking industry, a new opportunity and challenge has risen as the demand for the completely virtual banking experiences rises. Local banker Derek Scott echoes many experts in the area today, explaining the shift toward virtual banking as coming directly from the growing desire for convenience.

“The role of online banking has evolved from a convenience to a necessity as more and more customers utilize online interfaces to track their money. As a financial institution, we must continually adjust to meet expectations and consumer demand,” Scott said. Banks may approach the new demand differently, but one thing is clear: Every benefit has its downside, and the world of virtual banking is no exception. Greg Reames, regional president of Dogwood State Bank, hints at this idea as he speaks to the ease virtual banking brings.

“The pros revolve around convenience. If you are a college student that needs to pay your roommate for your half of the utility bill, it takes them less than a minute to use an app like Venmo to send the money. The cons will continue to be working to keep all these mobile/online transactions secure,” Reames said.

In the past, a bank robbery would usually entail months of planning and at very least a grand police chase, but now all that is required is a good scammer persona. First Bank Retail Banking Executive Bill Bunn believes one of the greatest challenges with online banking is helping customers understand the danger fraud and scammers pose, needing only a username and password to get to a lifetime of savings.

“All banks have multiple layers of security for their services,” Bunn said. “But when users are tricked by emails or text messages from fraudsters, they can unwittingly give away their login credentials and security codes which create hardship and sometimes financial loss.”

Scamming is not necessarily a new trend, but the ease at which a scammer can both contact a large number of people and leave without ever showing their face is a frightening new reality. Calls often come disguised as family members in need, or even emails claiming to be from the bank while asking for personal information. While fraud is a real challenge, banks are determined to continue helping customers understand how to better protect themselves and their finances.

For customers acquainted with online dealings, it is still difficult to discount the attraction of online banking in its ease of use, interface, and ability to make funds available without the wait time. Local banks, however, have found the push towards online banking to bring in new challenges, including the loss of personal relationships between the bank and its customers. Where one generation relied upon the wisdom of bankers they could speak to in person, another relies on apps that compare prices and advantages using algorithms- all at the click of a button.

Scott explains, this gap in how clients interface with banks has allowed banks to decrease in-person branches and use the finances from less staffing to support virtual needs.

For small banks like Lumbee Guaranty Bank, this has allowed them to focus more on their customer service, whether in person or virtually, and has led to a commitment to always having personalized customer service available no matter the technology in play.

The majority of local banks agree there is danger to virtual banking, but also rejoice in the benefits the new technology has brought to their businesses. Local banks can now give attention to their local clients, while also reaching more customers from around the United States.

Scott has seen the pros and cons of online banking, and in the end, advocates for relationships with local banks, even if the normal banking method is virtual. His reason? The face-to-face establishments genuinely want to take care of you.

“The best advice I can give is this, as it relates to the topic – build a relationship with your banker, whether that’s a teller, customer service, bank president, or someone like me, a commercial banker,” Scott said. “It never fails that one day something will go wrong regardless of fault and it’s vital to know you have someone to call who’s in your corner. Banking is personal and you should never feel like just a number. If you ever do, I urge you to visit a community bank to start the relationship.”

For many local banks in the greater Fayetteville area, life simply continues. They strive for the highest security standards, personalized customer service, and innovative new technology to continue caring for their customers amidst a quickly changing world. Customers caught in the whirlwind of change can breathe a sigh of relief knowing they still have their trusted banks ready with open doors to sit down with them as they navigate banking decisions. Customers who crave the ease of virtual banking can stick with their local banks as they continue working to produce secure and advanced apps making deposits and transfers as easy as clicking a button. For the local bank, the future is bright, and their focus on listening to the customer and continuing to stay ahead of technology remains.

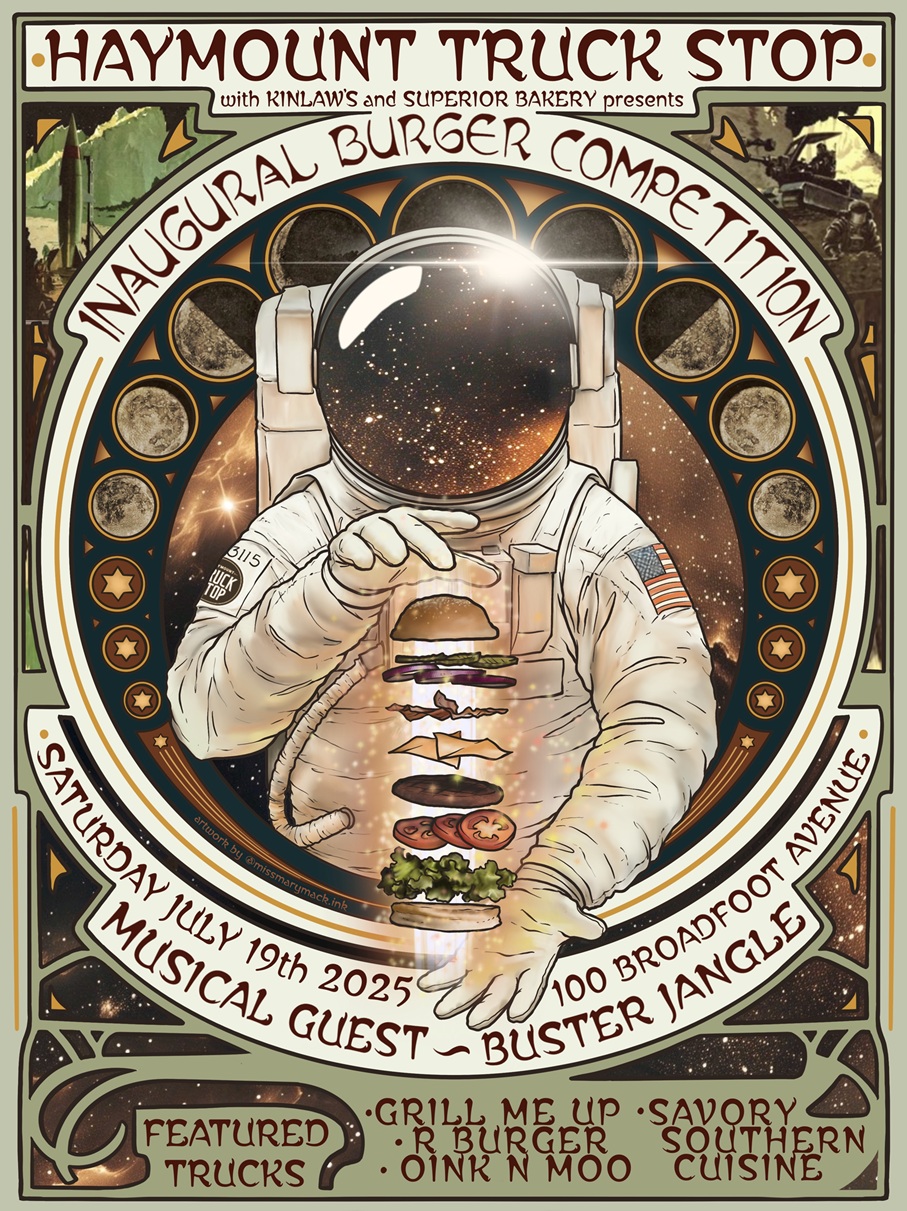

Cookout season is officially in full swing, and if you’re tired of grilling your own, the Haymount Truck Stop has an exciting option for the whole family! The Truck Stop’s inaugural burger competition is happening on Saturday, July 19.

Adiós. Au revoir. Auf Wiedersehen.No, I am not leaving the Greater Fayetteville Business Journal, but I am going on a long overdue vacation!Hello dear readers, this is my roundabout way of announcing to the community that starting on July 4, any and

In a city where traditional lending channels can overlook aspiring business owners from underserved communities, the Tulsa Initiative is changing the narrative around access to capital. The Fayetteville-based nonprofit has worked to expand its missio