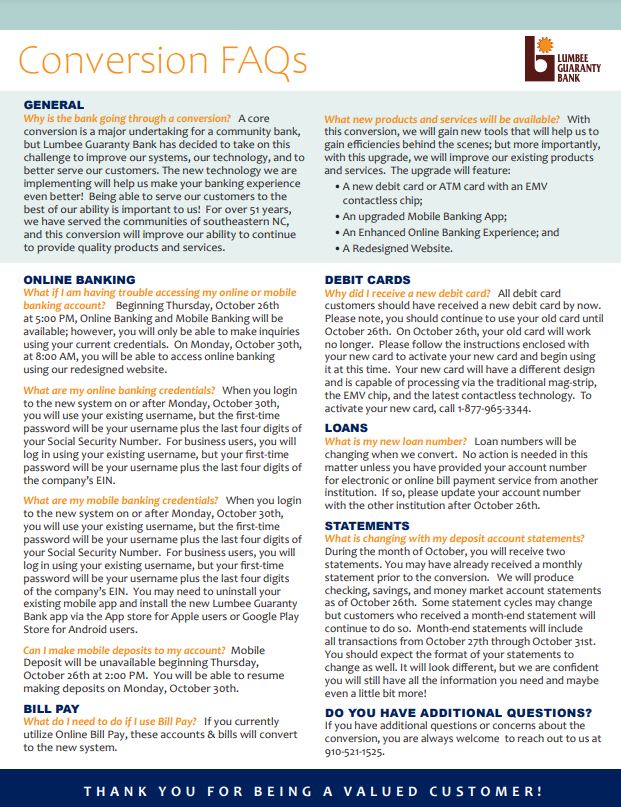

Starting on Thursday, Oct. 26, Lumbee Guaranty Bank will be undergoing an upgrade process on their “core” software systems. The process will be updating their systems behind most of their digital banking services including customer files, teller processing, ATMs and digital banking. The updates will also include a newly redesigned website.

With this conversion, LGB will gain new tools that will help them to gain efficiencies behind the scenes; but they will also be improving existing products and services.

The upgrade will feature:

•A new debit card or ATM card with an EMV

contactless chip;

•An upgraded Mobile Banking App;

•An Enhanced Online Banking Experience; and

•A Redesigned Website.

According to a written notice to customers on their website, the Bank has decided to take on this challenge to improve their systems, technology, and to better serve customers.

“It is a major undertaking, but we are expecting a successful conversion. Our new core provider, CSI, specializes in serving community banks, and we believe they are a strategic partner who can help us continue to grow and better serve southeast NC,” shared Lumbee Guaranty Bank CEO Kyle Chavis in a written response to GFBJ. “From this Thursday through Monday, there may be some minor interruptions in services as we change the systems over, but there should be intermittent issues only. Our employees are excited for the change and stand ready to answer any questions and concerns our customers have.”

According to Chavis, the Bank has sent multiple mailings to customers notifying them of the change and will also be emailing out an FAQ page to clients who may have questions about what services will be available and when.

It is important to note that all debit card customers should have received a new debit card by now, and will be able to continue to use your old card until October 26th. On October 26th, your old card will no longer work.

The full FAQ page regarding the conversion process can be found here.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as