North Carolina’s banks play a vital role with economic development and strengthening communities through their investments in homeownership, small businesses, and community development. According to a recent study conducted by Appalachian State University, the North Carolina banking sector supports nearly 176,000 jobs statewide and generates over $31.5 billion in annual economic activity, including $10.1 billion in incremental labor income.

“North Carolina’s banking industry is well-capitalized, highly liquid, profitable, and well-positioned to support the continued growth of our state’s economy. NCBA member banks range from the largest financial institutions in the nation to very small community banks and savings institutions, and they all serve their customers and communities

in unique ways, from large and complex transactions to basic loan and deposit services for North Carolina families and individuals,” said President & CEO of the North Carolina Bankers Association Peter Gwaltney in a press release. “This new report illustrates the many ways the banking industry positively impacts communities and our state’s economy.”

There are other ways that North Carolina’s banking industry supports families and local communities, including:

Empowering Homeownership and Affordable Housing

North Carolina banks contribute to making homeownership possible for many by originating approximately $41.5 billion in home loans annually. This financial support empowers thousands of North Carolinians to achieve the dream of homeownership, build equity, and actively invest in their communities. Additionally, programs like the

North Carolina Bankers Association’s Centrant Community Capital fund affordable housing, fostering stability and growth in communities statewide.

Supporting Small Businesses and Farmers

The state’s banking sector annually provides $9.9 billion in loans to small businesses and $1.3 billion to local farms. These financial resources are essential for entrepreneurs, enabling new business openings, operational expansions,

and sustained agricultural productivity. This lending not only supports the local economy but also creates jobs and promotes sustainable growth in both urban and rural areas.

Committed to Community Development

Beyond direct financial services, North Carolina banks invest in community-focused initiatives, funding local projects, and promoting economic growth in underserved areas. Banks across the state engage in charitable contributions and encourage employee volunteerism, amplifying their impact on community well-being. This collective commitment creates a ripple effect, supporting local businesses and enhancing economic resilience across North Carolina.

To learn more about the North Carolina Bankers Association, go to their website hhttps://ncbankers.org/ere. To receive a digital copy of their December 2024 Economic impact report contact CEO Peter K. Gwaltney at peter@ncbankers.org.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

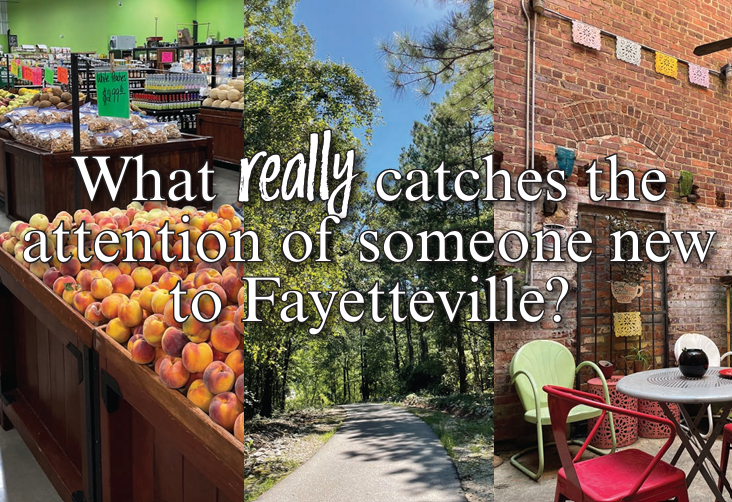

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as