On March 20, 2023, the Cumberland County Board of Commissioners approved an Interlocal Agreement with the county’s municipalities for Sales Tax Distribution. The agreement, which was also approved by all nine municipal boards, maintains the current per capita method of sales tax distribution within the County for the next two years. Starting with FY 2026, the Board intends to change the sales tax distribution method to ad valorem.

The new agreement provides a transition period for implementing the ad valorem distribution method, extending the current sales tax agreement and distribution method through June 30, 2025, with 100 percent of growth above FY 2022 actuals going to the County. As part of the agreement, County Commissioners expressed their intent to transition to the ad valorem method of distribution beginning July 1, 2025. This would also coincide with the implementation of the 2025 Property Reappraisal, when an increase in property values could potentially offset the negative impacts of the distribution method change to the municipalities.

The amended Interlocal Sales Tax Agreement has been approved by the County and all nine municipalities, and the County has not voted to change the distribution method to ad valorem. In the upcoming fiscal year (FY 2024), the distribution method will remain per capita with the approved agreement. Under the approved agreement, municipalities would not experience the revenue impacts related to the change in distribution until FY 2026.

Until then, the potential impact for the municipalities would be that they would not realize any additional revenue beyond FY 2022 actuals – and that any growth from that benchmark would go to the County as outlined in the approved agreement.

FY 2022 saw historic growth in sales tax revenue across Cumberland County, North Carolina and the United States. Because the approved agreement is based on this historic growth, as the economy and inflation begin to slow down, there is the possibility that there will be limited, or even negative growth in sales tax revenue above FY 2022 actuals. If that happens, the County would not realize any additional revenue, and the County and the municipalities would share the decline proportionally.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

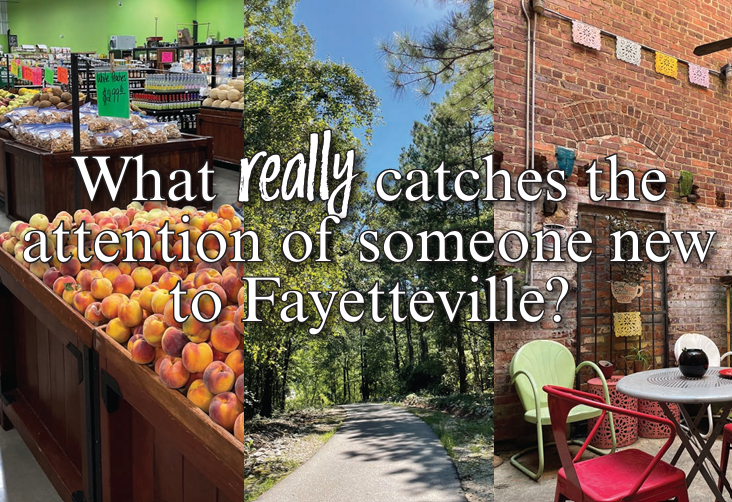

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as