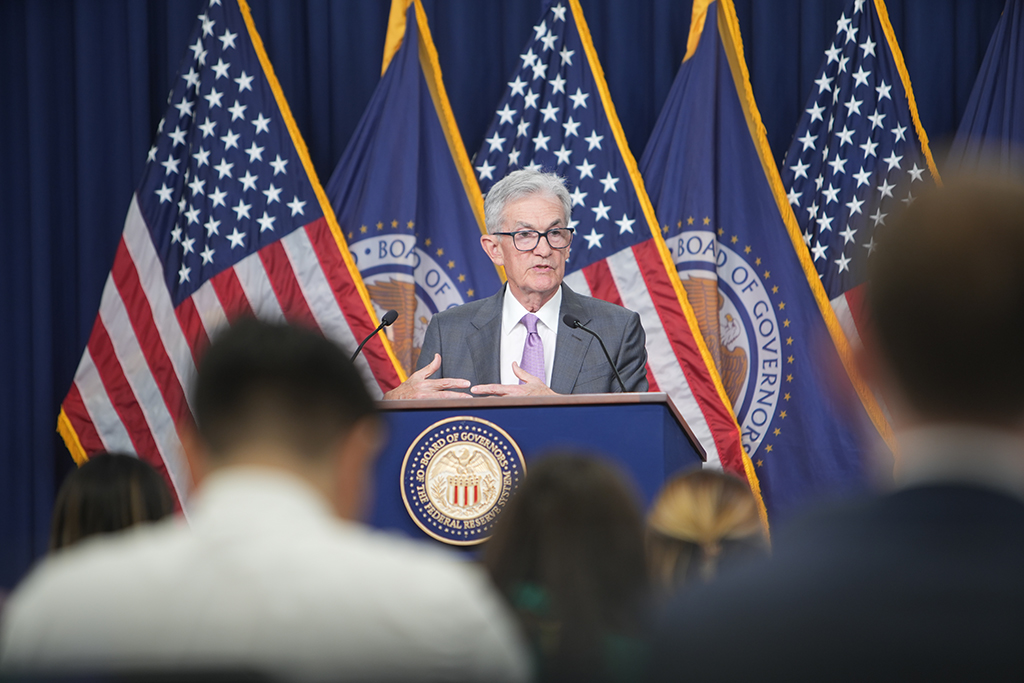

Today, Sept. 18, the Board of Governors of the Federal Reserve System decided to lower their policy interest rate by a half percentage point to 5% and voted unanimously to lower the interest rate paid on reserve balances to 4.9%, effective Sept. 19, 2024.

This is the first rate cut since the COVID-19 Pandemic.

Following a joint meeting of the Federal Open Market Committee and the Board of Governors of the Federal Reserve System on Tuesday, Sept. 17, 2024 and Sept. 18, 2024, the announcement was made by Board Chair Jerome H. Powell in a follow up press conference.

“Today, the Federal Open Market Committee decided to reduce the degree of policy restraint by lowering our policy interest rate by a half percentage point,” said Powell. “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance. Strength in the labor market can be maintained in a context of moderate growth, and inflation is moving sustainably down to 2%. We also decided to continue to reduce our securities holdings.”

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on Sept. 18, 2024:

"Effective Sept. 19, 2024, the Federal Open Market Committee directs the Desk to:

In a related action, the Board of Governors of the Federal Reserve System voted unanimously to approve a 1/2 percentage point decrease in the primary credit rate to 5 percent, effective Sept. 19, 2024. In taking this action, the Board approved requests to establish that rate submitted by the Board of Directors of the Federal Reserve Bank of Atlanta.

According to a statement released by the Federal Reserve:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2% objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In light of the progress on inflation and the balance of risks, the Committee decided to

lower the target range for the federal funds rate by 1/2 a percentage point to 4-3/4 to 5%. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook and the balance of risks. The

Committee will continue reducing its holdings of Treasury securities and agency debt and

agency mortgage‑backed securities. The Committee is strongly committed to supporting

maximum employment and returning inflation to its 2% objective.”

Powell reviewed the Federal Reserve Board’s summary of economic projections sharing:

“We are not on any preset course. We will continue to make our decisions meeting by meeting. We know that reducing policy restraint too quickly could hinder progress on inflation at the same time, reducing restraint too slowly could unduly weaken economic activity and employment. In considering additional adjustments to the targets from several funds rates, the Committee will carefully assess incoming data, the evolving outlook and the balance of risks,” said Powell.

Powell also shared that if the economy evolves as expected, the median participant projects that the appropriate level of the federal funds rate will be 4.4% at the end of this year and 3.4% at the end of 2025.

See the Fed’s full statement here, and a replay of the full press conference here. Find the Implementation Note here.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as