The Internal Revenue Service has announced that the amount individuals can contribute to their 401(k) plans in 2026 has increased to $24,500, up from $23,500 for 2025.

The IRS today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2026 in Notice 2025-67, posted on Thursday, Nov. 13 on IRS.gov.

Highlights of changes for 2026

The annual contribution limit for employees who participate in 401(k), 403(b), governmental 457 plans, and the federal government’s Thrift Savings Plan is increased to $24,500, up from $23,500 for 2025.

The limit on annual contributions to an IRA is increased to $7,500 from $7,000. The IRA catch‑up contribution limit for individuals aged 50 and over was amended under the SECURE 2.0 Act of 2022 (SECURE 2.0) to include an annual cost‑of‑living adjustment is increased to $1,100, up from $1,000 for 2025.

The catch-up contribution limit that generally applies for employees aged 50 and over who participate in most 401(k), 403(b), governmental 457 plans, and the federal government’s Thrift Savings Plan is increased to $8,000, up from $7,500 for 2025. Therefore, participants in most 401(k), 403(b), governmental 457 plans and the federal government’s Thrift Savings Plan who are 50 and older generally can contribute up to $32,500 each year, starting in 2026. Under a change made in SECURE 2.0, a higher catch-up contribution limit applies for employees aged 60, 61, 62 and 63 who participate in these plans. For 2026, this higher catch-up contribution limit remains $11,250 instead of the $8,000 noted above.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2026.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor the spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase‑out ranges for 2026:

Other phase-out ranges and limitations

The notice also provides limitations for 2026 for Roth IRAs, the Saver’s Credit and SIMPLE retirement accounts.

Details on these and other retirement-related cost-of-living adjustments for 2026 are in Notice 2025-67, available on IRS.gov.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

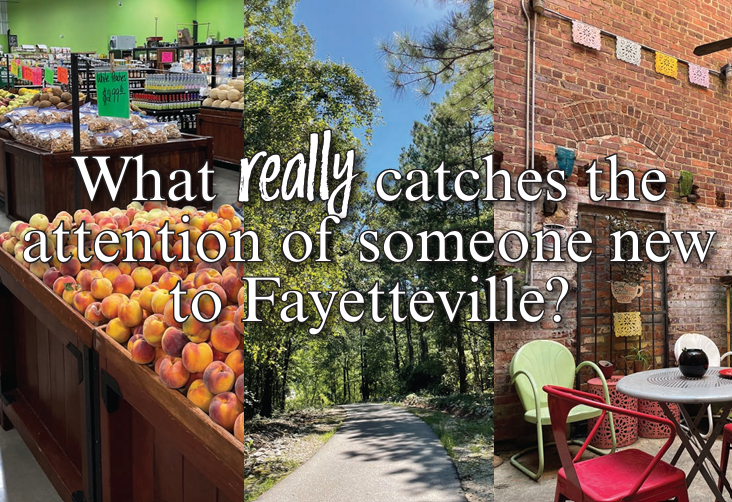

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as