Cumberland County Tax Administration has completed the 2025 Revaluation of real property within Cumberland County. As required by North Carolina state law, all real property must be reappraised at least every eight years. The purpose of the revaluation is to ensure tax assessments are uniform, fair and equitable for all citizens. Cumberland County is currently on an eight-year revaluation cycle, with the last revaluation conducted on Jan. 1, 2017.

Revaluation notices will be mailed to all Cumberland County property owners on Friday, Feb. 21, 2025. In advance of those notices, Cumberland County wishes to share the following information with property owners. Additional information will be included in the notices, on the County’s website and through other channels.

2025 Revaluation Timeline:

Appeals Process

Taxpayers who agree with the value shown on their notice do not need to respond. Taxpayers who disagree with the assessed value can complete the 2025 Revaluation Informal Appeal Form located on the back of each mailed notice. Appeal forms, along with instructions on how to appeal, are also available online at cumberlandcountync.gov/tax under the “Forms & Publications” tab.

Detailed information regarding the revaluation process and how to appeal will be included in each revaluation notice and on the Tax Administration website.

Tax Relief Programs

Cumberland County Tax Administration encourages taxpayers to review the eligibility requirements of three state-authorized tax relief programs:

These programs offer assistance to eligible taxpayers who are 65 or older and meet income requirements, 100% disabled and meet income requirements or Veterans with a total and permanent service-connected disability or their unmarried surviving spouse. For more information about tax relief programs, visit cumberlandcountync.gov/tax.

Contact Information

The Tax Administration Office can be reached by email for property and revaluation questions at taxrealestate@cumberlandcountync.gov.

After notices have been mailed, taxpayers can call the County’s Revaluation Call Center at 910-678-7800 for questions or to schedule an appointment with an appraiser.

Tax Administration is located on the fifth floor of the Judge E. Maurice Braswell Cumberland County Courthouse, 117 Dick St., in Fayetteville.

For more information about Cumberland County, visit cumberlandcountync.gov, follow the County on social media at CCNCGov and download the County app by searching MyCCNCGov in the app store.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

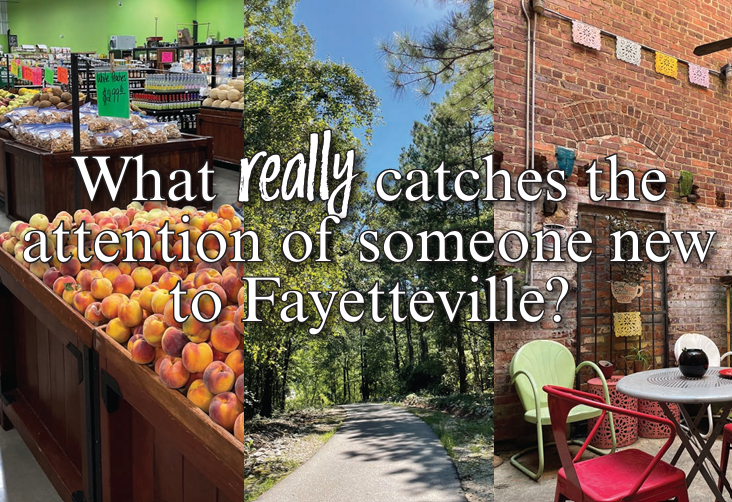

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as