Cumberland County property owners have until March 24 to request an informal review of their 2025 assessed value. The Office of Tax Administration recently completed the 2025 revaluation of all real property to reflect fair market value as of January 1, 2025.

Informal Appeal.

Taxpayers should submit detailed information and/or documentation that supports their opinion of value. This may include, but is not limited to, update of property characteristics or a recent appraisal. Appraisers will review all requests and contact taxpayers if more information is needed or to further discuss the value. Taxpayers will receive a letter of the outcome when the review is completed. If the outcome is agreed upon by the taxpayer, no further actions are necessary.

Property owners may further appeal their value by submitting a formal appeal to the Board of Equalization and Review (BER). Formal appeals are heard and decided by the BER. Members of the board will consider both information submitted by the appellant and the County appraiser. An informal appeal is not required to submit a formal appeal.

Formal Appeal

Taxpayers can submit requests for both informal reviews and formal appeals:

Taxpayers may view their property record card and 2025 assessed value online at www.taxpwa.co.cumberland.nc.us/camapwa.

More information regarding revaluation and how to appeal is included in each revaluation notice and online at cumberlandcountync.gov/tax.

For questions or to schedule an appointment with an appraiser, contact the Revaluation Call Center at 910-678-7800 or email at taxrealestate@cumberlandcountync.gov.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

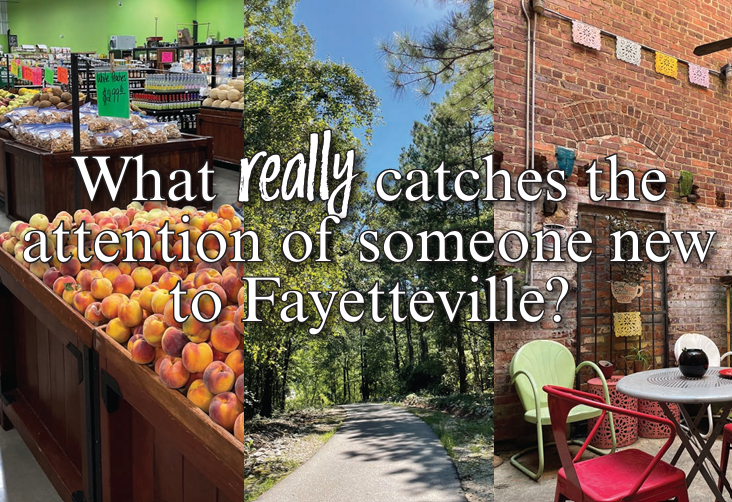

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as