Cornerstone Capital Bank, a preeminent national provider of residential mortgage finance and loan servicing solutions and consumer, commercial, and institutional banking services, has launched a joint venture company with homebuilders in Fayetteville, North Carolina.

Based in Fayetteville, North Carolina, Liberty Ridge Lending is a partnership with local homebuilders JSJ Builders and Ben Stout Construction. The company serves homebuyers across Fayetteville and the surrounding Raleigh suburbs, with a strong focus on assisting military families near Fort Bragg.

"Our partnership in Liberty Ridge Lending demonstrates our shared commitment to make homeownership more accessible and provide seamless financing solutions for buyers," said Chris Blount, regional manager of the Atlantic Coast region at Cornerstone, in a press release. "Facilitating this collaboration has been an exciting journey, and I look forward to the positive impact this partnership with JSJ Builders and Ben Stout Construction will have on our community."

Cornerstone has now formed and managed joint venture mortgage companies for 15 homebuilders nationwide. These new companies deliver faster loan approvals and a seamless mortgage experience for homebuyers while giving homebuilders greater certainty in closing homes on time, better control of their backlog and a dedicated home financing and bank partner in Cornerstone.

“What kind of got the juices flowing on setting up a mortgage company, I think, from our perspective, was the ability to kind of control the transaction and all the elements that go into it to create a great experience for the people that purchase our new construction homes…And then really what it developed into was a full service mortgage company, both that it can service our customers that are looking to buy any type of residential property, and then our new construction became just another byproduct of that operation. So it's really been exciting and fun to make that happen,” shared Ben Stout, owner of Ben Stout Construction.

The business launched in January 2025 and they’ve just hired a second loan officer who is bilingual to allow them to cater to an even wider client base as operations continue to ramp up.

“It's definitely been impactful in better understanding there's multiple different ways to help facilitate a buyer get into a home. You know, sometimes it's your closing costs, sometimes it's the rate, sometimes it's a combination of those two things, and to see the team go about trying to figure out the best option based upon each individual buyer's needs, has been fun to see,” remarked Stout.

To learn more about Liberty Ridge Lending go to the company website:

https://www.houseloan.com/liberty-ridge/

Owners Dana and Tracy Horne planted their vineyard in 2009. In 2019, they introduced their u-pick vineyard, and visitors loved the addition. They’ve also added a 4,608 sq ft. venue available to rent for events. Photo by Emily Grace Photography.Twiste

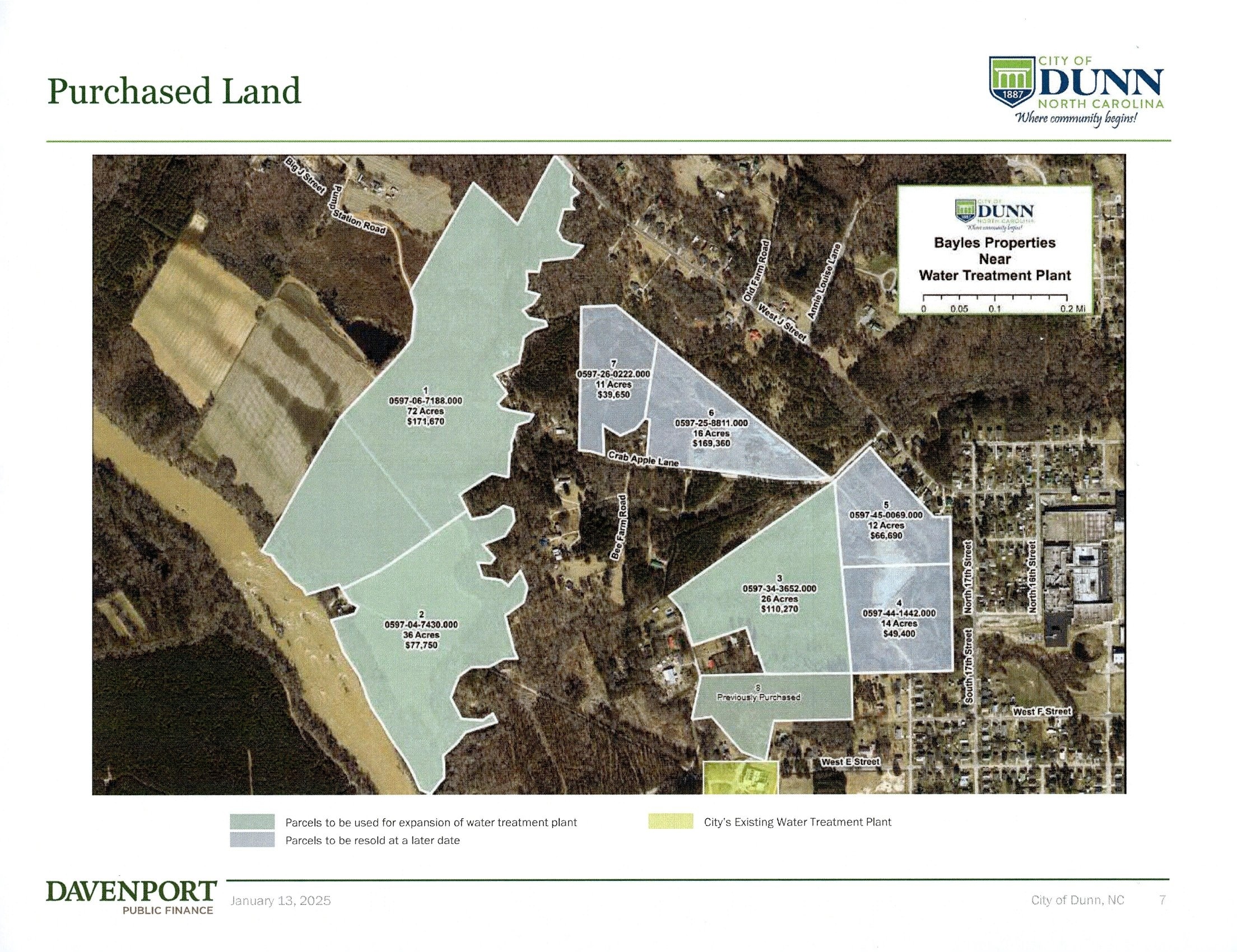

Mayor Elmore saw the necessity for this land acquisition when he first took office six years ago. The land owner recently came around to negotiations on the condition the sale was for all of his parcels. This is more land than the City of Dunn curren

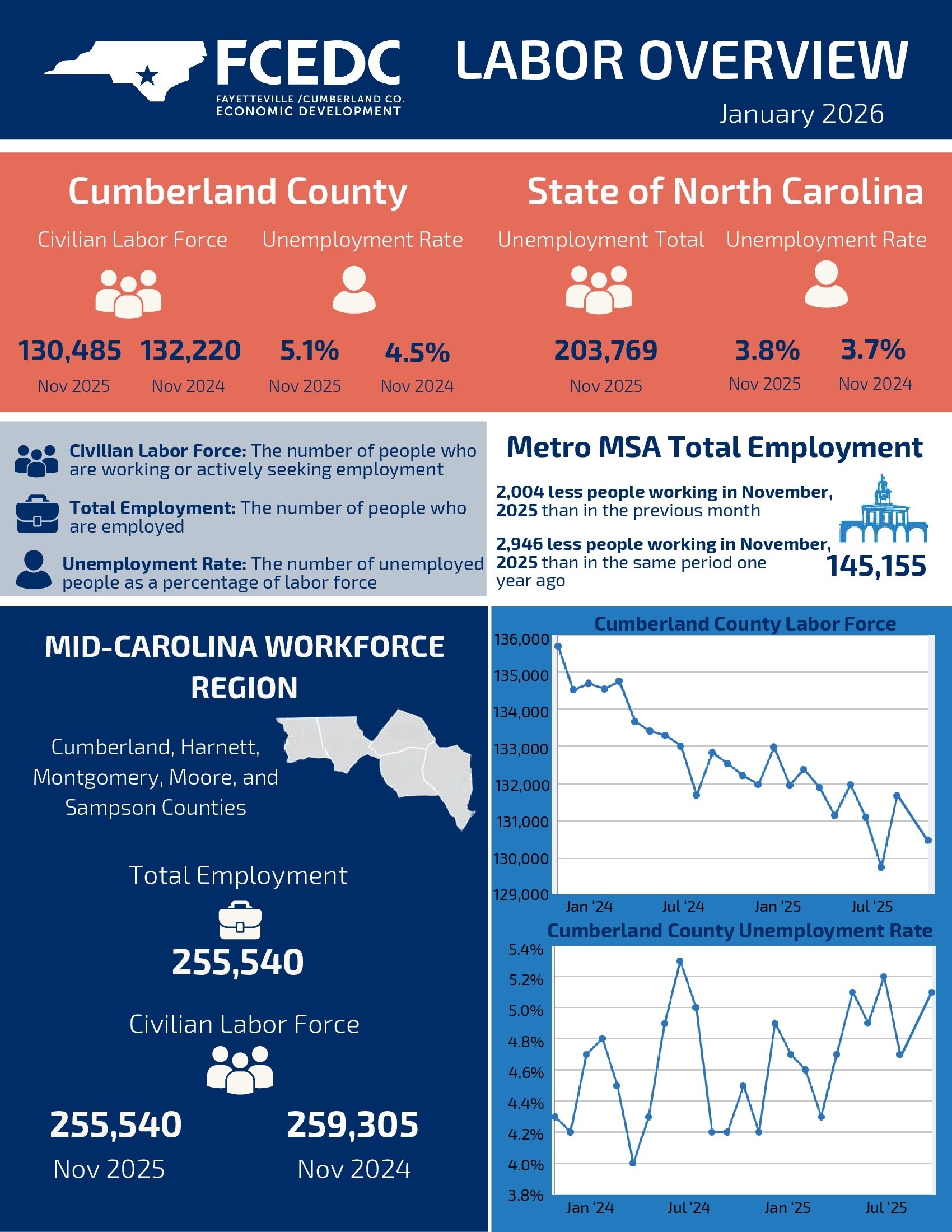

While the weather outside is cold, the local job market is hot. Fayetteville employers continue to bring on additional talent across a variety of industries.Quality employment opportunities are available at companies across Fayetteville and Cumberlan