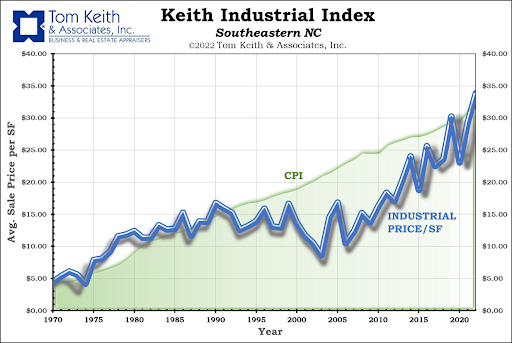

Throughout the past 50 years, industrial development and the market in general has seen many swings. Tom Keith & Associates, Inc. has been collecting Industrial Building sales data since 1970, which has allowed our appraisers to track and retrospectively determine reliable valuations on industrial buildings in Southeastern North Carolina. Some of these trends were unforeseen, but many were predicted by numerous economists and politicians: Ross Perot with his “giant sucking sound” speech in a 1992 Presidential debate being the best-known example.

As noted by the chart above, multiple swings of average prices are shown throughout the history of the Industrial Market in Southeastern NC. The first trend in this historical reference can be seen from 1970 to 1990, in which a general inflationary level of price increases of industrial manufacturing and warehousing was conserved as a strong growth in the service, and retail trades began slowly overcoming the industrial section[1]. It is also well known that the industrial market in this initial period was mostly affected by a strong textile manufacturing sector, which helped prices keep up with general inflation. This stable period was followed by the previously mentioned prediction of the significant loss of industrial demand as a whole, likely caused by the North American Free Trade Agreement (NAFTA) seen from 1990 to 2007.

As trade increased with less developed nations, the United States as a whole, including our local market, lost many manufacturing operations; therefore, negatively affecting the industrial real estate market for over a decade later. The Southeastern NC industrial market started another uptrend as we were coming out of the 2008 Recession. Likely caused by the expansion of online retail, general economic growth and lack of new development of industrial properties, the price/sf of industrial properties began to increase faster the annual rate of the Consumer Price Index (CPI) around 2007 and this annual growth of about 7.60 percent per year continued until present day (2023). As the cost of new building materials and demand for warehousing space rapidly increased during the Covid-19 Pandemic, we saw such reflection in the industrial markets, unlike many other real estate markets.

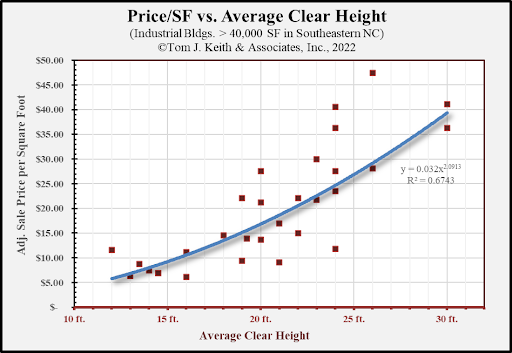

In this growing market there has also been an increase in demand for warehouse storage space with less focus on the manufacturing side. Being that storage capacity is becoming a large factor we have seen a much stronger correlation between the ceiling height or clear height of space and sale price. The chart below illustrates this trend.

The chart above also indicates the correlation between Sale Price/SF and Average Clear Height of industrial buildings in Southeastern NC. Clear height is the height of the interior of a building between the floor and the lowest hanging beam, or light structure in a given area. In this analysis there were 30 industrial building sales between 2013 and 2019 in Southeastern NC of buildings between 40,000 to 140,000 SF and between 15 and 75 years of age. These sales were pulled from similar slower growing markets, which excluded faster growing markets such as Raleigh and the Wilmington MSA. The intention by this selection is for the purpose of isolating the variable in question, clear height. A market adjustment for time of 4 percent annually has been placed on all these sales in order to more isolate the clear height variable. After the appropriate adjustments, the appraiser feels confident that a large portion of any conflating variables have been either adjusted appropriately or taken out of the study due to being substantial outliers.

The relationship between Sale Price per Square Foot and Clear Height is a major factor in the purchase, leasing, or development of any large industrial building. The reason such a significant correlation is present is due to the ability to store and warehouse items by stacking and racking. One specific trend seen besides the obvious correlation is the noted increase in price and demand for space with a clear height of greater than 18 feet.

Copyright 2022, Tom J. Keith & Associates, Inc.

[1] Monthly Labor Review – September 1990, Bureau of Labor Statistics, Lois Plunkert, 1990

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as