There has been a considerable slowdown in the development of multi-family and single-family residences over the last several years, which, along with inflation in building prices, has led to increasing rental rates.

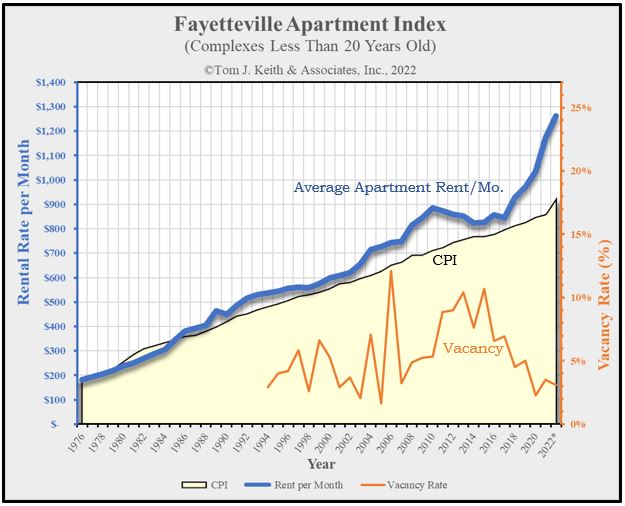

This Fayetteville Apartment Index chart is based on data collected since 1976 by the staff of Tom J. Keith & Associates, Inc.[i] The survey includes rental and vacancy rates for two-bedroom units in complexes less than 20 years old (at the time of collection), with over 100 units included in the tabulation. This chart also shows growth in the Consumer Price Index (CPI)[ii] in relationship to the rise in rental rates seen over the last 46 years. While there are other indexes that are associated more directly with housing, they were not in place at the beginning of this study. Projects over 20 years old are also surveyed but not included in this index.

As shown in the Apartment Index chart, average apartment rents have grown fairly consistently compared to the CPI until around 2017. Between 2017 and 2022 (Q2), rental rates increased 49.35 percent overall, while the CPI only increased 15.78 percent. The CPI includes the cost of rent or a mortgage, but, based on the analysis, there is a considerable difference in the growth rates of rental rates and the CPI over the last few years.

The most reasonable explanation for a large portion of this recent discrepancy in growth rates can be found primarily found in the cost of construction. The Marshall Valuation Service reports a 43.8 percent increase in cost to build multi-family developments in the Eastern U.S.[iii] between 2017 and 2022, which indicates the rental rate after inflation (referred to as the Real Rental Rate in this report) increased only 5.55 percent over a five-year period, or 1.11 percent annually. Knowing this, it appears Fayetteville’s Real Rental Rate has only gradually increased due to underlying inflation of the cost to develop such units.

Another takeaway from our analysis is the significant decrease in unit vacancy with a simultaneous increase in the rental rate over the last five years. As appraisers and de facto economists, we question what significant underlying cause(s) can explain the decrease in vacancy rate and increase in rental rate other than general market inflation. The factors that most affect Real Rental Rates and Vacancy are: (1) the number of units available in the market (supply) and (2) the population increase and movement to multi-family dwellings (demand).

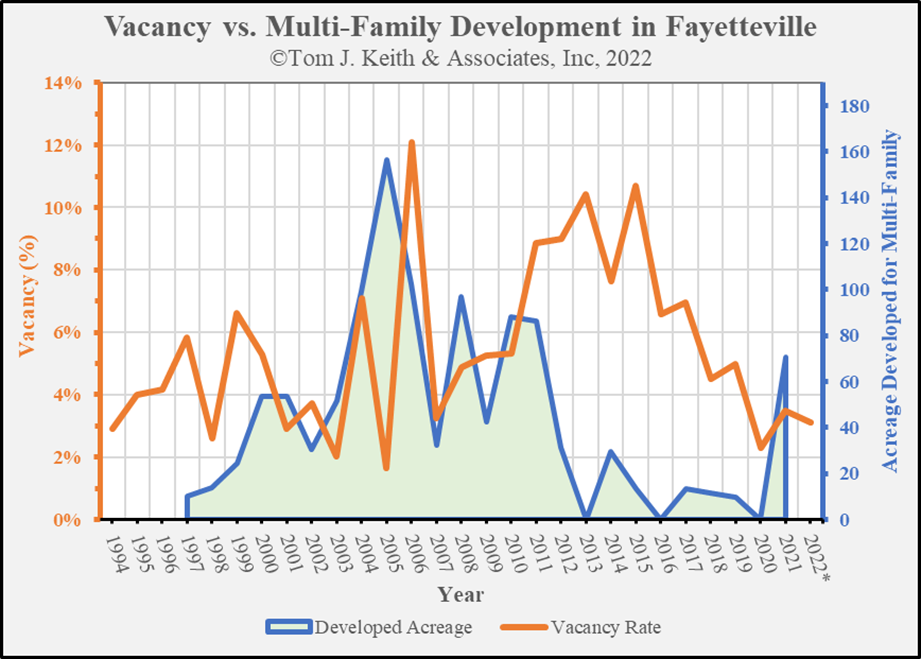

Since Cumberland County’s population has only seen an increase of between 0.50 percent to 0.70 percent annually over the last ten years[iv], demand alone cannot be driving the low vacancy rate. Therefore, we must examine the supply of apartment units. Through our firm’s analysis of comprehensive land sales over the last few decades, we determined an approximate amount of acreage purchased and developed for multi-family use in Fayetteville. We also analyzed the number of residential building permits in Fayetteville. In examining the data on both supply chain points, we noted the considerable slowdown in the development of multi-family units and single-family residences over the last few years (shown in the Vacancy vs. Multi-Family Development in Fayetteville chart below). This slowdown in development has most definitely been a contributing factor to the rental rate increase and vacancy rate decrease.

The Vacancy vs. Multi-Family Development in Fayetteville chart above also shows somewhat of a delayed positive correlation between the two variables, meaning as development decreases, vacancy will also decrease over time. Between 2003 and 2012, Fayetteville multi-family development was consistently high compared to other parts of our market. This appears to have been fueled primarily by the promises of BRAC (Base Realignment and Closure), which sought to move a significantly larger amount of military personnel to Fort Bragg and the Fayetteville Metropolitan Statistical Area (MSA).

As seen in the Vacancy vs. Multi-Family Development in Fayetteville chart, once the new supply of apartment units was available, vacancy rates quickly rose from 2010 until 2015. During this period of higher vacancy, hardly any multi-family development took place, resulting in a decrease in vacancy and an increase in rental rates.

In conclusion, there appears to be a potential for some significant development of apartment units in the Fayetteville market. With only 65± acres being currently developed for multi-family so far this year our local developers will need to build considerably more units in order to slow these historically high rental rates, and open more available living spaces for all citizens of our city.

Copyright 2022, Tom J. Keith & Associates, Inc.

[i] Staff of Tom J. Keith & Associates, Inc.: Tom J. Keith, Kelly Williams, Yolanda Lilly, Dr. David Duke, Brandon Wills, Claudia Atkins, Alex Keith and many others helped compile the apartment rental data from 1976 to current day.

[ii] U.S. Bureau of Labor Statistics, https://www.bls.gov/cpi/

[iii] Marshall Valuation Service, CoreLogic, 2022, Section 99, Page 4, July 2022.

[iv] NC Department of Commerce, Labor & Economic Analysis Division, County Profile, Cumberland County (NC), 2022 https://accessnc.nccommerce.com/DemoGraphicsReports/pdfs/countyProfile/NC/37051.pdf

Jamel Williams transitioned from active military duty to the civilian workforce in 2018. He entered into the field of real estate with the hope of helping other military personnel find their home, as he knew from firsthand experience the challenge th

rom Concept to Capability panelists (L to R) Dr. Paul Baker principal deputy (A) of the Army Science Division Army Research Office, Klinton Snead, extramural staff director for the Army Research Office, panel moderator Phil Williams, VP of corporate

Photo by Tierra Mallorca / Unsplash Buying a house is not for the weak. This year, my husband and I decided to begin the hunt for a home. When I tell you January was one of the most stressful times in my life, I mean it from the bottom of m