By the time you read this, Jerome Powell, chairman of the Federal Reserve and the rest of the Federal Reserve board will have undoubtedly lowered the federal reserve borrowing rate by at least 25 basis points or a 1/4 percent. Some expect it to be a higher cut, and it is highly likely that it will be lowered 75 to a full 100 basis points before the end of the year.

The reason the markets are already reacting to this inevitability is the signals being given from Powell himself stating that the inflation target is pretty close to its goal at 2.5% versus the 2% fed target. The poor jobs performance in the last month may keep the initial rate cut down a bit, but a rate cut is coming nonetheless.

But many of you might be asking the question, ‘If inflation is coming down significantly, why are prices still high?’

It’s a fair question, and one that I didn’t know the answer to completely, so I asked AI to help me answer the question. If you’re not sure what AI is by now, you may have been asleep for the last two years, and it’s time to wake up! Of course, AI stands for artificial intelligence, and here’s what AI says, regarding the question that I posed:

While inflation has been slowing, prices are still high because a decrease in inflation means prices are increasing more slowly, rather than falling.

Here are some reasons why prices are still high:

I actually looked over many of the articles that this information was sourced from, and it appeared to be accurate, assuming the articles themselves are accurate!

The reality is, although manipulating the federal borrowing rate up brings inflation rates down, competition also has a significant long term impact on inflation. Once again, I asked AI to define how competition affects inflation and this was the answer below:

PRICE MODERATION

Competition can help moderate prices by encouraging companies to lower prices, and by increasing supply and production efficiency.

ECONOMIC FLEXIBILITY

A competitive economy can adapt more easily to changes, which can help minimize the impact of shocks on price stability.

PRICE FORMATION

Competition can help price formation processes function better, which can help inflation persist for less time.

ECONOMIC RESILIENCY

Promoting competition can help strengthen the economy’s resiliency.

In a nutshell, my take on all of this is we need a fiscal policy that promotes entrepreneurship by lowering corporate taxes to incentivize investment and growth. This will increase competition. A lower federal borrowing rate will help businesses invest in supply and inventory. This will help lower prices. A lower rate will also help businesses invest in employment growth. These are key elements to promoting competition and lowering inflation.

Either way, cheers to a lower borrowing rate! Keep it up Fed! Now, on to promoting competition among everyone else.

God bless you and yours!

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

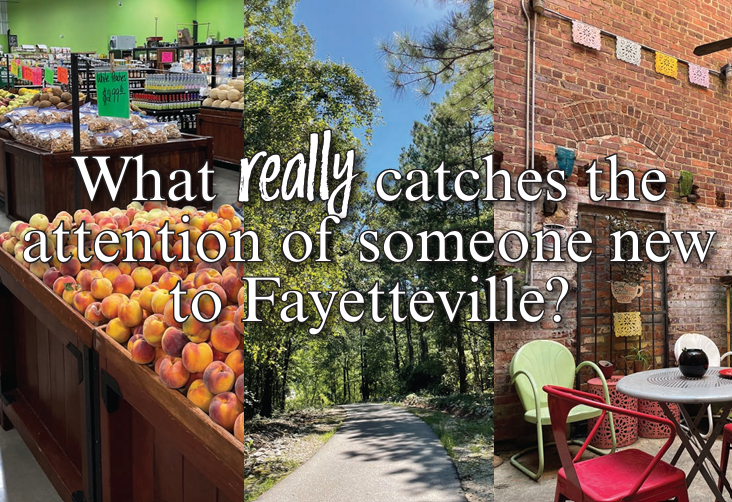

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as