Cumberland County Tax Administration reminds residents about available property tax relief programs for those who qualify. These programs offer assistance to eligible agricultural, disabled, elderly and Veteran property owners.

Present-Use Value Deferment Program

This program allows qualifying agricultural, forestry, horticultural and wildlife conservation properties to be assessed based on their current use rather than market value. Taxes under this program are deferred, not exempted, and remain a lien on the property. Applications for the 2026 tax year must be submitted during the annual listing period (Jan. 1 - 31, 2026). To qualify, properties must meet specific requirements, including:

Elderly or Disabled Exclusion Program

This program excludes from taxation the greater of:

Eligibility requirements:

Disabled Veteran Exclusion Program

This program excludes from taxation the first $45,000 of the assessed value on the permanent residence of a qualifying disabled veteran or their unmarried surviving spouse. There are no age or income limitations for this program.

The application deadline for both the Elderly/Disabled and Disabled Veteran Exclusion programs is Monday, June 1, 2026.

To request an application or learn more about tax relief programs, contact Cumberland County Tax Administration Customer Service online at cumberlandcountync.gov/tax, by phone at 910-678-7507 or in person on the fifth floor (Room 530) of the Judge E. Maurice Braswell Cumberland County Courthouse.

For specific inquiries, residents are encouraged to email:

Present-Use Value Deferment Program: taxrealestate@cumberlandcountync.gov

Elderly/Disabled and Veteran Programs: taxrelief@cumberlandcountync.gov

Business Personal Property: taxbpp@cumberlandcountync.gov

General Inquiries: taxweb@cumberlandcountync.gov

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

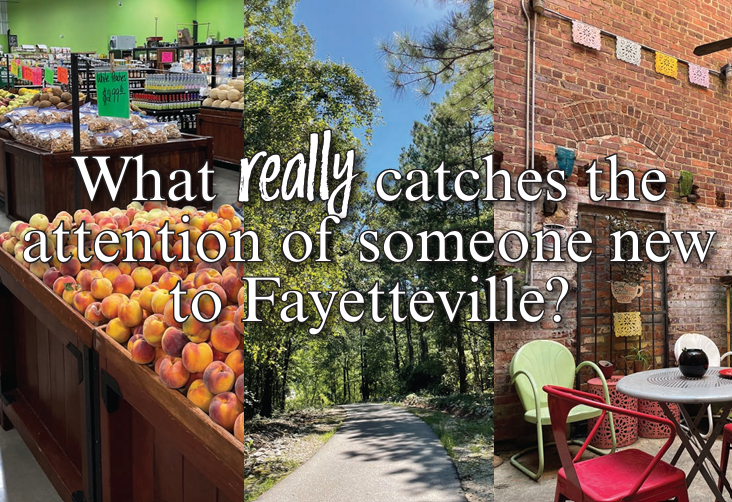

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as