The City of Fayetteville is working to ensure that every resident has the education, financing and long-term potential to own their own home within city limits with the Homebuying HERO program.

An acronym for Homebuyer Education and Readiness Opportunity, the Homebuying HERO program is the rebranded version of the City’s homebuyers program, which seeks to enable long-term, successful homeownership by providing citywide homebuyer education and counseling services that produce certified home buyers who qualify for fixed-rate, responsible lending mortgage loans. The program offers qualifying first time homebuyers up to three options in gap financing available towards the purchase of a new home.

THE HOMEBUYING HERO PROGRAM HAS THREE TIERS: Citizen HERO, Public Service HERO and City Employee HERO.

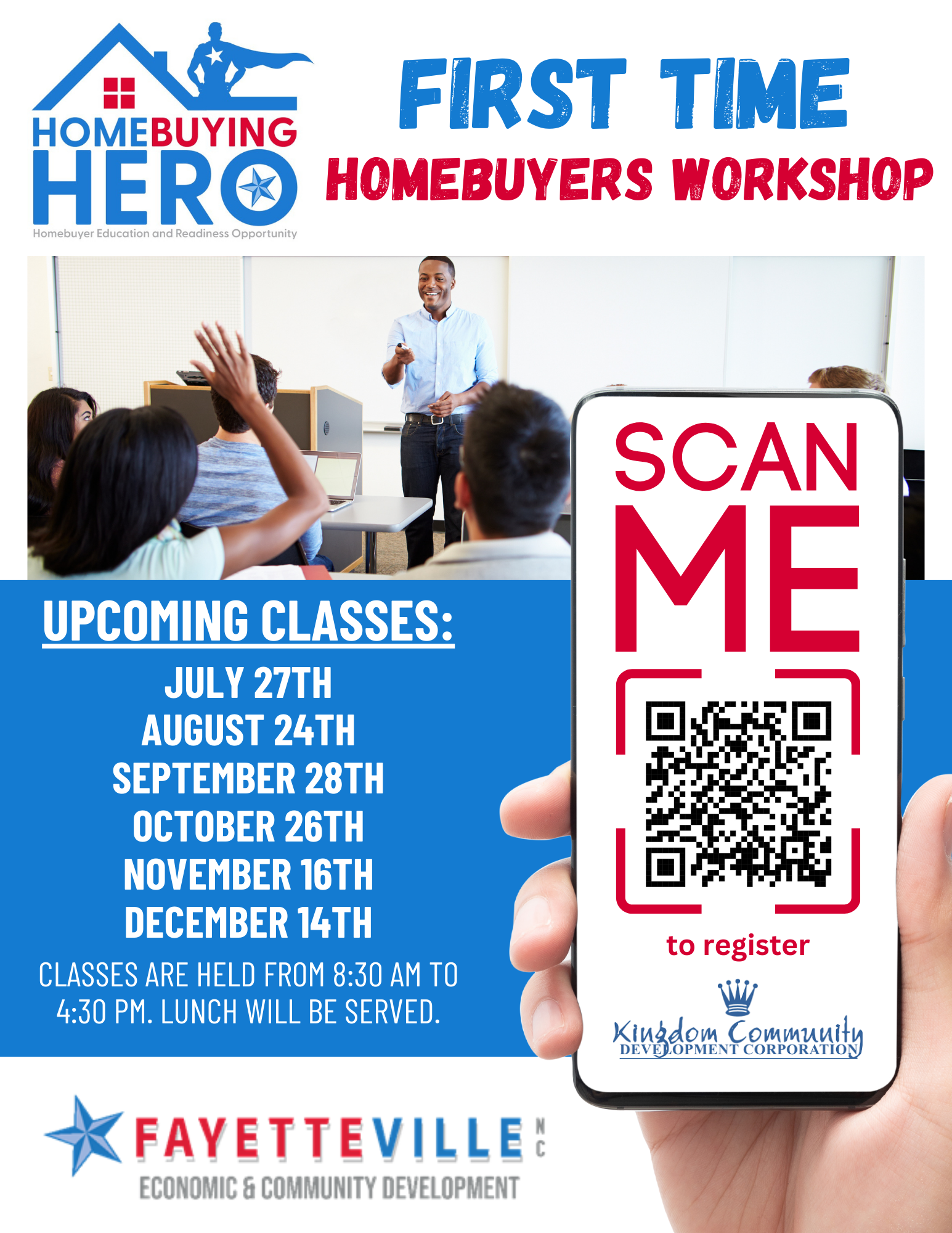

The program starts with education. The City of Fayetteville has partnered with the Kingdom Community Development Corporation to host First Time Homebuyers Workshops. These workshops were designed to teach participants the essentials to buying your first home including budgeting for homeownership, shopping for a home, obtaining a mortgage, closing procedures and the responsibilities of maintaining the home after purchase.

The courses are offered at Fayetteville Technical Community College every fourth Saturday of the month from 8:30 a.m. - 4:30 p.m. The course is led by counselors who are approved by the U.S. Department of Housing and Urban Development (HUD) who connect with students (AKA HEROs) to walk with them through their home buying journey.

“When you buy your first house, it’s a daunting task, and if you don't have parents or family members to guide you through that process, it can feel insurmountable without the right educational pieces in place,” said Director of Economic & Community Development Chris Cauley. “That class is the gateway into programs that the city offers.”

But the education doesn’t stop with a course. The counselors will continue to work with their HEROs to make sure they have the healthy finances necessary to maintain the home.

“Once they complete that workshop, they are given a certificate. The certificate is good for one year. Next is the one-on-one counseling that is tailor made just for that borrower or homebuying HERO and they talk about things that are on their credit report,” said Bernadine Simmons, a community development specialist with the City of Fayetteville. “The borrower will bring a copy of their credit report and they’ll look at where they might be having barriers to homeownership such as late payments, debt to income ratio being more than it should be, maybe they have things on their credit report that are errors. So the HUD Counselor works with that borrower to help eradicate those things. Because the credit report is a clue to your financial health.”

In order to qualify for funding, the person must meet the definition of a first-time home buyer as outlined by HUD: A person who has not had principal ownership of a property within a three-year period. The home for purchase must be classified as a single-family home (attached or detached) or a modular home. Manufactured or single or doublewide homes are not eligible for the program. The home must also be located within City limits to be eligible.

“A lot of people think that because the address says Fayetteville, that it’s within the City limits. Understanding the geographic nature of the city limits is important. And that’s something that we can verify if somebody’s got a question about it,” said Jeffrey Morin, housing manager with the City of Fayetteville.

While the program has expanded to include more potential qualifying participants, the financing is a loan through the City of Fayetteville with a goal to retain residents and employees by including a built-in affordability period depending on the borrower’s classification.

For a City Employee HERO, assistance will be given in the form of a 0% interest loan forgiven over a five-year affordability period. For a Citizen or a Public Service HERO, assistance is given in the form of a 0% interest loan forgiven over a five 10-year affordability period.

“It's prorated every year that you live in the home depending on how much you got. Let’s say it was the full $30,000 that would give you a 10-year affordability period, so every year, $3,000 would be forgiven off of that loan,” said Morin. “As you work down through that full 10 years, at the end of 10 years the loan is gone. You owe zero money to the City. It’s not accruing any interest during that time. We’re just tracking to make sure that it’s your primary residence. We check that annually. As long as that's happening, we’re marking it that you’re meeting the requirements and we’re forgiving that loan.”

“Our goal is to not deny a client if we can get them approved through our framework here and make sure every lender and the majority of the realtors know about it. All we can do is try to make sure that everybody knows about it, and when it is right for them, we’re here ready,” concluded Cauley.

The City of Fayetteville Economic and Community Development department is ready to aid the community with this program. More information on the program including income requirements, can be found online at www.fayettevillenc.gov/city-services/ economic-community-development/residents.

Mike BerkMike Berk is still getting settled into his new office and home, but his enthusiasm for his new role as CEO of Longleaf Pine REALTORS® is already in full swing. Just a few weeks into the job, the association management veteran sat down with