The Internal Revenue Service (IRS), working with the U.S. Department of the Treasury, announced on Tuesday, Sept. 23, that paper tax refund checks for individual taxpayers will be phased out beginning on Sept. 30, 2025, as required by Executive Order 14247, to the extent permitted by law. This marks the first step of the broader transition to electronic payments.

The IRS will publish detailed guidance for 2025 tax returns before the 2026 filing season begins. Until further notice, taxpayers should continue using existing forms and procedures, including those filing their 2024 returns on extension of a due date prior to Dec. 31, 2025.

The change is designed to:

What this means for individual taxpayers:

According to the IRS, most individual taxpayers already receive their refunds by direct deposit into their bank accounts. During the 2025 tax filing season, the IRS issued more than 93.5 million tax refunds to individual income tax filers, and 93% of those, almost 87 million refunds, were issued through direct deposit. Only 7% of individual refund recipients received their refunds by check through the mail.

Executive Order 14247 also applies to payments made to the IRS. Taxpayers should continue to use existing payment options until further notice. Additional guidance and information for filing 2025 taxes will be issued prior to the 2026 filing season.

The IRS will share updated guidance on IRS.gov and through outreach efforts nationwide. To find you local office, you can go to the IRS Locator page on their website here.

Kristen Botts co-founded the program with her husband, Nathan Botts, who is a Veteran himself. Photos provided by Kristen Botts.An organization helping Veterans live a full life after their service in the U.S. Military wants to connect Veterans and d

Patrick NoblesHuntington Bancshares Incorporated announced on Feb. 2 that it has closed its merger with Cadence Bank, a regional bank headquartered in Houston, Texas and Tupelo, Miss. This strategic partnership accelerates Huntington’s growth in

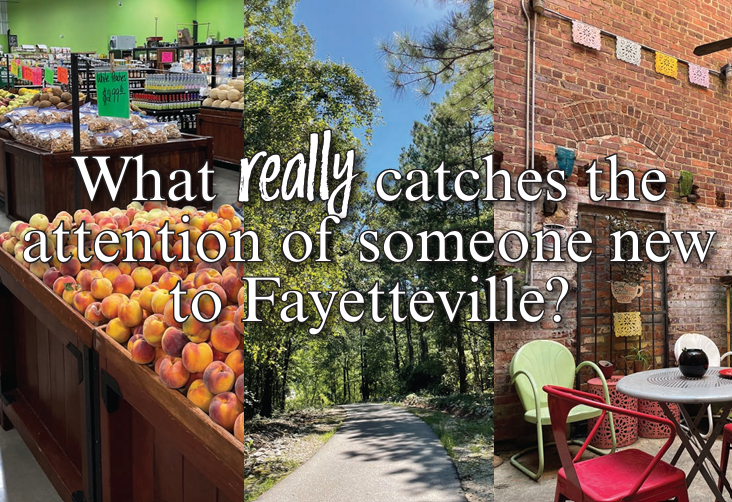

There is extensive dialogue surrounding Fayetteville as a travel destination or city aimed at recruiting new businesses and new residents. As someone who moved here from out of state, I thought it could be fun to share my personal experience as